Unit 11, Block 8, Blanchardstown Corporate Park 1, Dublin 15, D15 AX6K

www.pensionadvice.ie

01‐9125030

TERMS OF BUSINESS

(v 01/01/2022)

These Terms of Business are effective from 01/01/2022 and set out the general terms under which we will provide business services to you and the respective duties and responsibilities of both ourselves and you in relation to such services.

Please ensure that you read these terms thoroughly and if you have any queries, we will be happy to clarify them. If any material changes are made to these terms, we will notify you.

AUTHORISATION & CODES OF CONDUCT

Gen Z Financial Solutions Ltd trading as Pension Advice and Zed Insurance is regulated by the Central Bank of Ireland. Our Authorisation code is C143985. We are subject to Consumer Protection Code, Minimum Competency Code and Fitness & Probity Standards which offer protection to consumers.

The Central Bank of Ireland holds registers of regulated firms. You may contact the Central Bank of Ireland on 1890 777 777 or alternatively visit their website at www.centralbank.ie to verify our credentials and these codes. Gen Z Financial Solutions Ltd are member of Brokers Ireland.

OUR SERVICES

We are an Insurance, Investment, and a Mortgage Credit Intermediary. Our principal business is to provide advice and arrange transactions on behalf of clients in relation to Life, Pensions, Investments and Mortgages.

We are not under a contractual obligation to conduct Insurance distribution business exclusively with one or more Insurance Undertakings and do not give advice on the basis of a fair and personal analysis, we do however provide advice from the selection of products provided by the Companies and Lenders we have agencies with.

We recommend the product that, in our professional opinion, is best suited to your needs and objectives from this selection of products.

As part of the process when giving our clients advice on Investments we will need to gather information with regards your investment knowledge and experience, if this information is not provided, we will not be in a position to determine whether the product is appropriate for you.

We will need to collect sufficient information from you before we can offer any advice on housing loans. This is

due to the fact that a key issue in relation to mortgage advice is affordability. Such information should be

produced promptly upon our request.

Where the creditor isunable to carry out an assessment of creditworthiness because the consumer chooses not to provide the information or verification necessary for an assessment of creditworthiness, the credit cannot be granted.

COMPANIES AND LENDERS WE HOLD AGENCIES WITH

Life & Investment Companies

Aviva Life & Pensions Ireland DAC

Irish Life Assurance Plc

New Ireland Assurance Co Plc

Royal London

Standard Life

Zurich Life Assurance Plc

BCP Asset Management DAC Blackbee Investments Ltd

Cantor Fitzgerald Ireland Ltd Conexim Advisors Ltd

Greenman Investments

J&E Davy

Independent Trustee Co Ltd

Newcourt Pension Trustee Ltd

Mortgage Providers

Brokers Ireland NetworkServices Ltd

DISCLOSURE OF INFORMATION

We act as your representative to the companies we have agencies with, and we will provide assistance to you for any queries you may have in relation to the policies or in the event of a claim during the life of the policies and we will explain to you the various restrictions, conditions and exclusions attached to your policy.

However, it is your responsibility to read the policy documents, literature, and brochures to ensure that you understand the nature of the policy cover.

Material information about medical history, non‐

smoker status, occupation category and any hazardous pursuits are central to underwriting decisions and it is imperative that all information you provide to the

insurer is accurate and complete.

You are under a duty to answer all questions posed by the insurer or ourselves on your behalf, honestly and

with reasonable care. It is presumed, unless the

contrary is shown, that you would know all questions

in an application or at renewal is material to the risk undertaken by the insurer or the calculation of the premium by that insurer, or both. Any failure to

disclose material information may invalidate a claim

and render your policy void. You must inform and disclose any material information including any

material changes that might take place between the

time you complete an application form and the time

your pay the first premium.

To assist us in providing you with a comprehensive service and to keep our records as up‐to date as soon as possible, please notify us of any changes to your personal circumstances, e.g., name change, change of address, etc.

ADVERSE SUSTAINABILITY IMPACTS STATEMENT

After due consideration with regards the legislation on Sustainable Finance Disclosure Regulation, due to our size and the type of business we transact with our clients, we have decided not to consider adverse impacts of investment decisions on sustainability factors in our investment and insurance‐based Investment advice.

The reason we have decided this course of action is because we do not produce these investments, it is the Product Producers we have agencies with that build the Investment Products we advise on.

Within the next year we will consider whether we will continue with this view, to ensure we stay within the guidelines of the legislation.

All information re Sustainable Finance Disclosures will be adhered to by the Product Producers and their brochures and documents will outline their disclosures.

If any of the investments we provide advice on have a Sustainability Finance Disclosure, these investments will be produced by the product providers we have agencies with, and their brochures and documents will have full details of the areas that are considered.

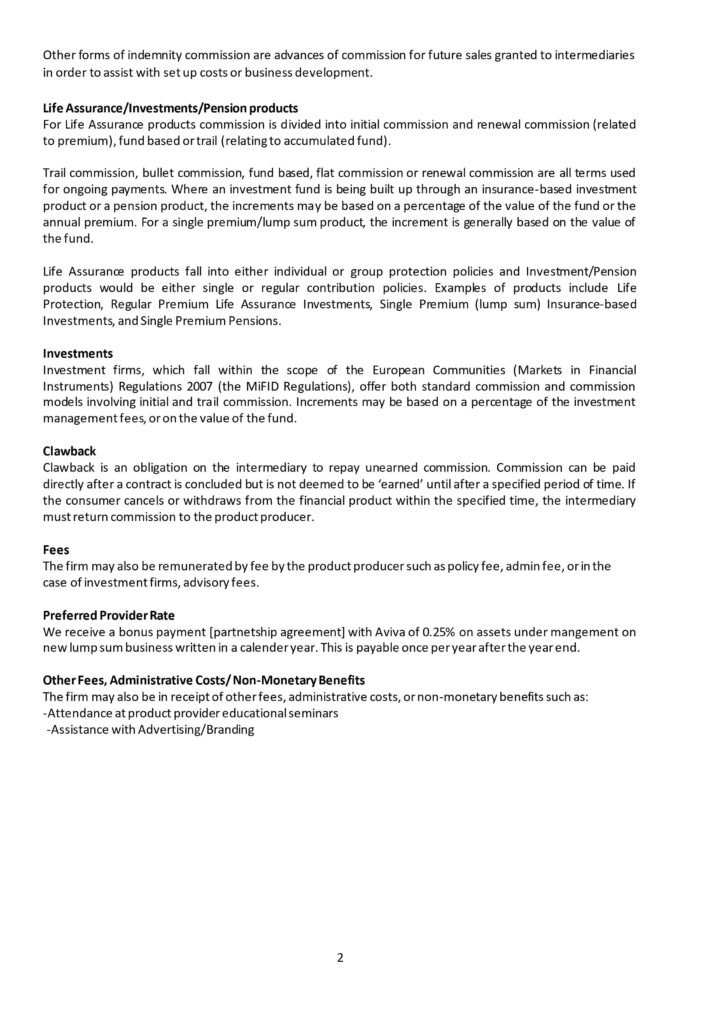

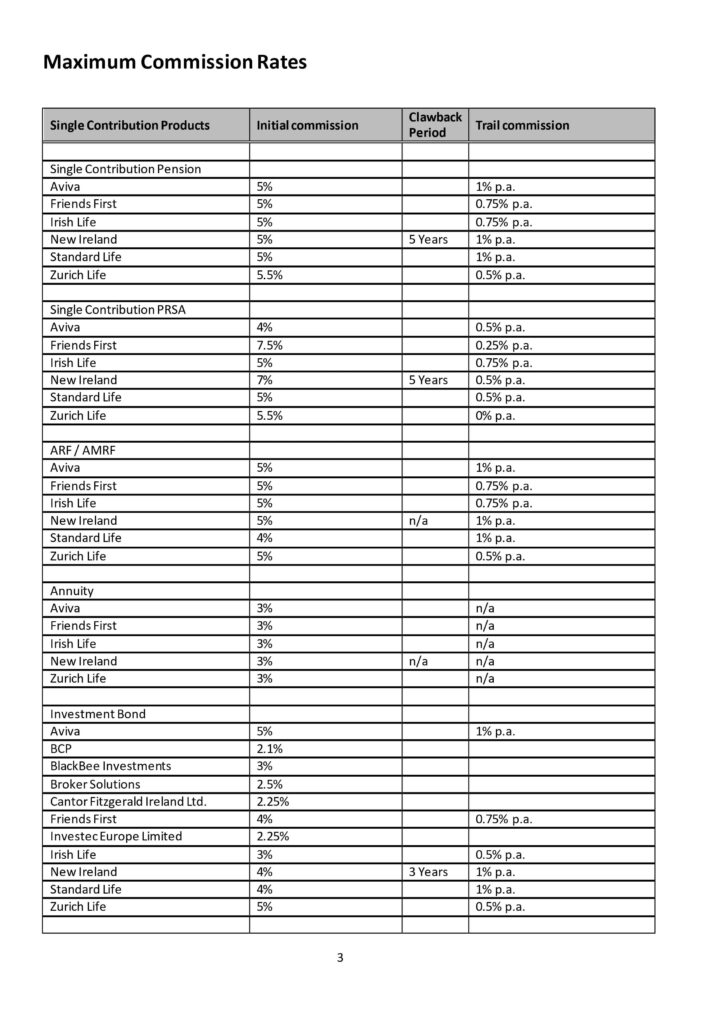

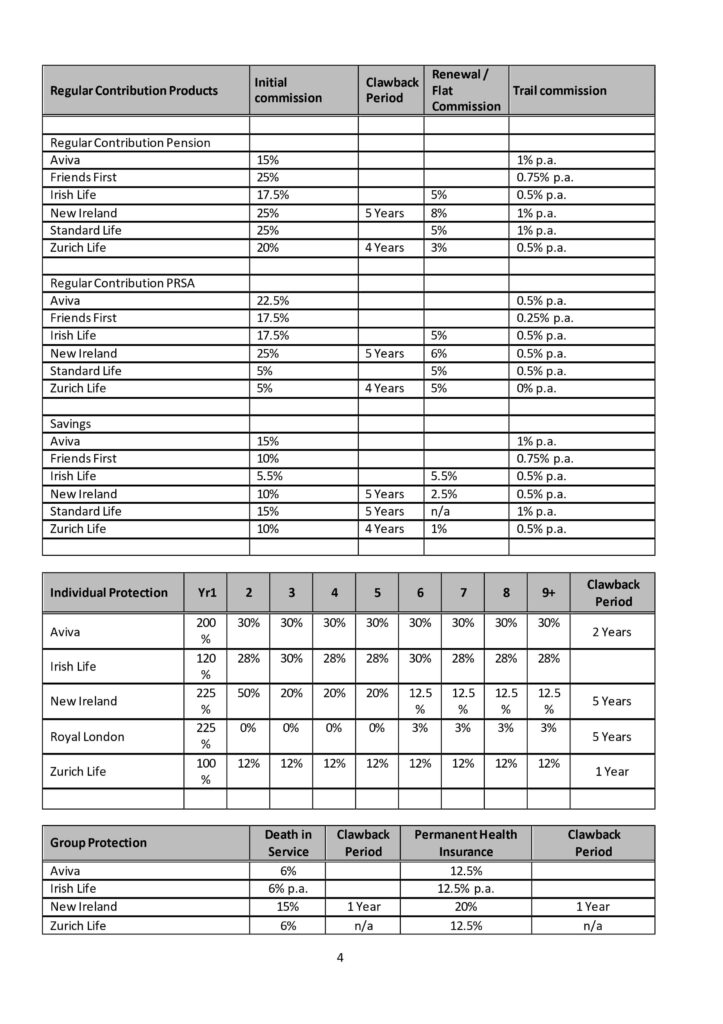

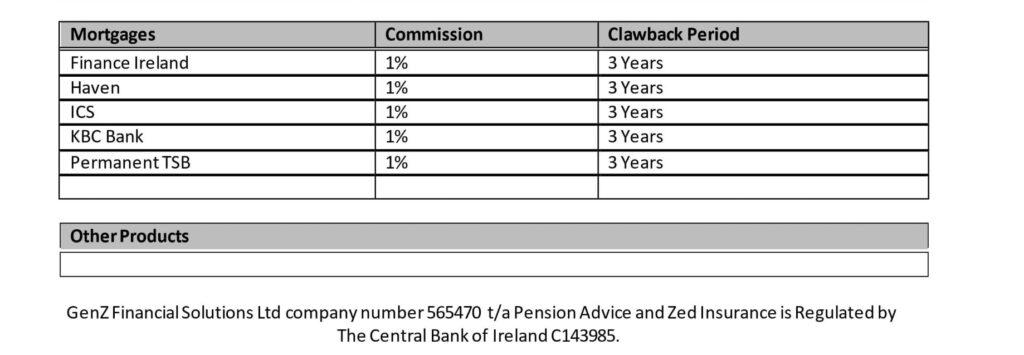

REMUNERATION

Gen Z Financial Solutions is remunerated by commission and other payments from product producers on the completion of business. You may choose to pay in full for our services by means of a fee. Where we receive recurring commission, this forms part of the remuneration for ongoing advice with regards to the business we advise you on and we will provide you with an annual update on your investment business. We reserve the right to charge additional fees if the number of hours relating to on‐going advice /assistance exceeds 20 hrs.

If we receive commission from a product provider, this will not be offset against the fee which we may charge you. Where the commission is greater than the fee due, the commission will become the amount payable to the firm unless an arrangement to the contrary is made.

We may receive up to 1% (or whatever maximum is applicable) of your loan for arranging mortgage finance from the lenders. The actual amount of commission will be disclosed at a later stage in the ESIS (European Standardised Information Sheet) which will be forwarded to you at loan offer stage. Please note that lenders may charge specific fees in certain circumstances and if this applies, these fees will be specified in your Loan Offer. A full list of lenders and remuneration is available on request. All costs valuations etc. must be paid by you.

A summary of the details of all arrangements for any fee, commission, other reward or remuneration paid or provided to us by the product producers” is available on our website. If you need further explanation on this information, please do not hesitate to call us.

FEES

You may elect to deal with us on a fee basis. The following hourly rates apply:

Director: €250 per hour

Qualified Financial Advisor: €150 per hour

Additional fees may be payable for complex cases or to reflect value, specialist skills or urgency. This can range from €200 per hour to €500 per hour. We will notify youin writing in advance and agree the scale of fees to be charged. Our services do not include ongoing suitability assessments.

We may charge you a fee for advice on mortgages which is payable in addition to any commission we may be paid by the lenders.

REGULAR REVIEWS

It is in your best interests that you review, on a regular basis, the products which we have arranged for you. As your circumstances change, your needs will change. You must advise us of those changes and request a review of the relevant policy so that we can ensure that you are provided with up‐to‐date advice and products best suitedto your needs.

CONFLICTS OF INTEREST

It is our policy to avoid conflicts of interest in providing services to you. However, where an unavoidable conflict of interest arises, we will advise you of this in writing before providing you with any service. If you have not been advised of any such conflict, you are entitled to assume that none arises.

DEFAULTS ON PAYMENTS BY CLIENTS

Gen Z Financial Solutions Ltd will exercise its legal rights to receive payments due to it from clients (fees) for services provided. Mortgage lenders may seek early repayment of a loan and interest if you default on your repayments. Your home is at risk if you do not maintain your agreed repayments.

CLIENT MONIES & RECEIPTS

We request that all cheques or negotiable instruments are made payable to the appropriate Product Provider for Life,Pensions, Investment business.

We shall issue a receipt foreach payment received, these receipts are issued with your protection in mind and should be stored safely. Every effort is made to ensure that clients’ money is transmitted to the appropriate Product Provider without delay. We arenot authorised to accept cash.

The acceptance by Gen Z Financial Solutions Ltd of a completed proposal DOES NOT in itself constitute the effecting of a policy. It is only when the Provider or Lender confirms the policy is in place or loan is drawn down that your policy is live.

COMPLAINTS

We have a complaints procedure in place which is available on request. Your complaint can be in writing, email, telephone or face to face. If your complaint is face to face or by phone, we will write to you to confirm our understanding of your complaint.

We will acknowledge your complaint within 5 business

days, advising you of the name of the person dealing with your complaint on behalf of the company. If in the event, a complainant is dissatisfied with the outcome of our investigation, you are entitled to refer the matter to the Financial Services & Pensions Ombudsman, Lincoln House, Lincoln Place, Dublin 2, Lo call 01 5677000 email‐ info@fspo.ie.

All complaints should be sent for the attention of Chris McKenzie, Gen Z Financial Solutions Ltd, Unit 11, Block 8, Blanchardstown Corporate Park 1, Dublin 15, D15 AX6K.

DATA PROTECTION

We comply with the requirements of the Data Protection Acts 1988‐2018. Gen Z Financial Solutions Ltd is committed to protecting and respecting your privacy. Our Data Privacy Notice will be given to you at the time of data collection. We may use 3rd party providers for onboarding of clients, these companies will also be regulated and adhere to the GDPR and Central Bank rules.

COMPENSATION SCHEME

We are members of the Investor Compensation Scheme. The Investor Compensation Act, 1998 provides for the establishment of a compensation scheme and the payment,in certain circumstances, of compensation to certain clients (known as eligible investors) of authorised investment firms, as defined in that Act. Compensation may be payable where money or investment instruments owed or belonging to clients and held, administered, or managed by the firm cannot be returned to those clients for the time being and where there is no reasonably foreseeable opportunity of the firm being able to do so. A right to compensation will only arise if the client is an eligible investor as defined in the Act and if it transpires that the firm is not in a position to return client money or investment instruments owned or belonging to the clients of the firm and to the extent that the client’s loss is recognised for the purposes of the Act. Where an entitlement to compensation is established, the compensation payable will be the lesser of 90% of the amount of the client’s loss which is recognised for the purposes of the Investor Compensation Act, 1998 or compensation of up to €20,000. For further information, please contact the Investor Compensation Company Ltd at 01 224 4955.

GOVERNING LAW AND BUSINESS SUCCESSION

The terms of business shall be governed by and construed in all respects according to the laws if the Republic of Ireland and will be deemed to cover and successors in business to Gen Z Financial Solutions Ltd.

Directors Chris McKenzie CFP®| SIA | QFA & Chris Crowley SIA | RPA | QFA.